#Best investment newsletters 2022 free

Call now at 1-88 or visit to schedule a free consultation and learn how our experience can help you recover your investment. With a 95 success rate, let us help you recover your investment losses today. As Claude Erb, a former fixed-income and commodities manager at mutual-fund firm TCW Group, put it to me in an email: “The people who can truly stomach the volatility of a 100% stock portfolio are either catatonic or dead. is a national law firm that specializes in fighting ONLY on behalf of investors. In fact, an index fund may well be an inappropriate standard against which to judge these newsletters, since few investors are actually willing to stick with an index fund through a bear market. It’s only when these managers’ returns are analyzed in light of their reduced risk that their value is appreciated. But that may not be a reason to shun them. With that said, I should note that while the Honor Roll newsletters have outperformed the typical service not on the Honor Roll, they on average have not outperformed a broad stock-market index fund.

#Best investment newsletters 2022 how to

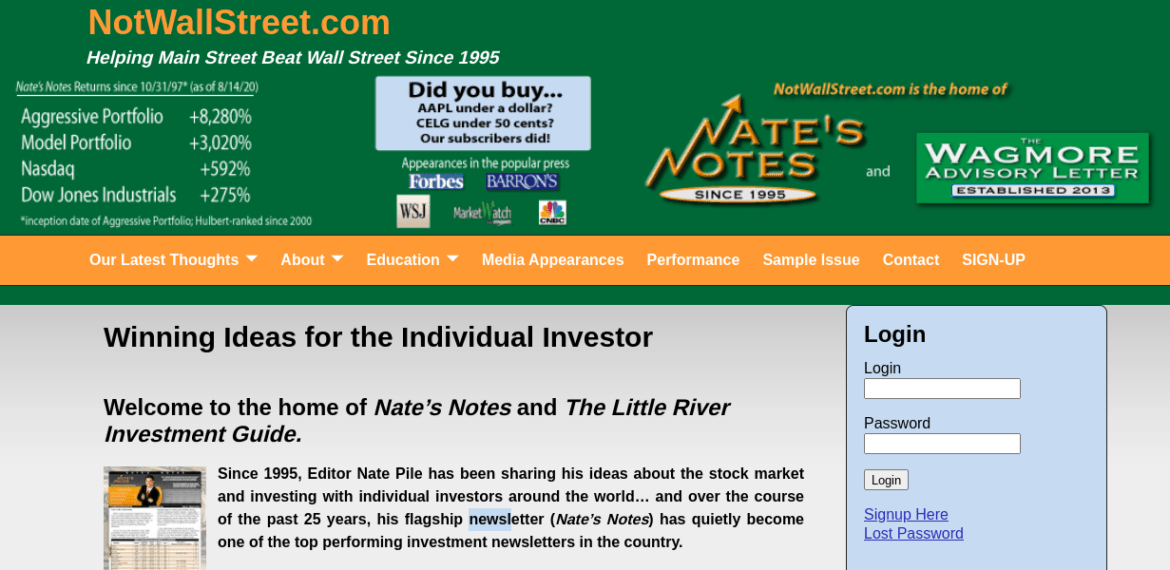

Read: Here’s how to boost returns while reducing riskĬurrently, just six newsletters among those I monitor make the Honor Roll: On average, the model portfolios of the Honor Roll newsletters have been 25% less risky than the overall stock market, as measured by the volatility of their returns - even as they’ve also outperformed the newsletters that did not make my Honor Roll by 2.7 percentage points per year over the last decade. Few managers satisfy these dual criteria, but those who do tend to have both good returns and low risk - just the kind of manager that anxious investors are more likely to follow through thick and thin.Įach year for two decades I have compiled a list of investment newsletter editors who meet these dual criteria I call it my Investment Newsletter Honor Roll. So what’s the solution for skittish investors? One option is to only follow managers who have historically produced above-average performance in both up- and down markets.

Read: The 7 tough questions you need to ask your financial adviser This doesn’t work for everyone many skittish investors find the attendant volatility too much too take. Lynch instead recommended that investors stick with his fund through thick and thin, which is indeed one way of overcoming these constant whipsaws. This meant they bought at the high and sold at the low, which is a reliable way to lose money. What was evidently happening was that many investors were only buying into the fund after it had rallied, then selling after a correction. equity fund over the trailing two decades, and yet he told those advisers that more than half the investors who’d ever owned the fund had lost money. His fund at that time was the best-performing U.S. The crucial role psychology plays in investment success was brought home to me in a powerful way in the early 1990s after reading something that Peter Lynch, the legendary manager of Fidelity Magellan fund, told a group of financial advisers. Tips for financial freedom from Nobel Prize winners

0 kommentar(er)

0 kommentar(er)